Media

Corporate News

Back

| Highlights |

|

18 March 2025, Hong Kong – Leading PRC-based professional sportswear enterprise Xtep International Holdings Limited (the “Company”, together with its subsidiaries, the “Group”) (Stock code: 1368. HK) today announced its annual results for the year ended 31 December 2024 (“2024” or “the year”).

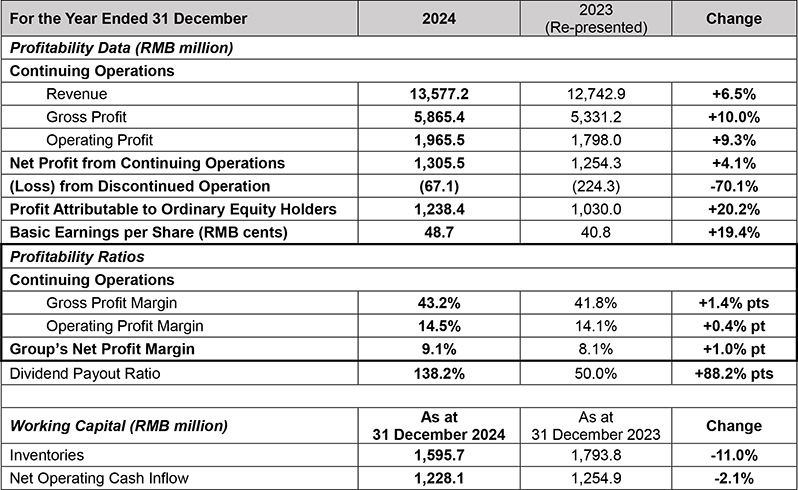

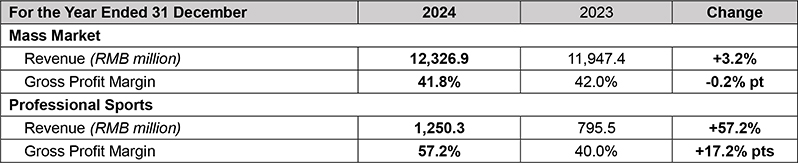

Against the backdrop of a volatile economic environment, the Group delivered a solid set of results for 2024. Revenue of the Group’s continuing operations increased by 6.5% to RMB13,577.2 million (2023: RMB12,742.9 million). Revenue of the core Xtep brand increased by 3.2% to RMB12,326.9 million (2023: RMB11,947.4 million). Revenue of professional sports segment realized a year-on-year growth of 57.2% to RMB1,250.3 million (2023: RMB795.5 million). Operating profit of the Group’s continuing operations increased by 9.3% to RMB1,965.5 million (2023: RMB1,798.0 million). Operating profit of the professional sports segment recorded a remarkable 829.5% increase to RMB78.2 million (2023: RMB8.4 million). Profit attributable to ordinary equity holders of the Company reached a new all-time high of RMB1,238.4 million (2023: RMB1,030.0 million), an increase of 20.2%. Basic earnings per Share was RMB48.7 cents (2023: RMB40.8 cents).

The Board has proposed a final dividend of HK9.5 cents per Share, with an option to receive scrip shares in lieu of cash. Together with the interim dividend of HK15.6 cents per Share, the full year dividend payout ratio was 50.0%. Additionally, with a special dividend of HK44.7 cents per Share, the total dividend increased by 221.7%, resulting in a payout ratio of 138.2% (2023: 50.0%).

Mr. Ding Shui Po, Chairman and Chief Executive Officer of Xtep International Holdings Limited, said, “The Group’s strategic focus on running has bolstered our ambition to be the most preferred brand for both elite and mass market runners in China. In 2024, our ‘professional-to-mass influence’ strategy has proven effective, enabling us to evolve from being the number one brand for sub-three-hour marathon runners to achieving the highest overall wear rates in the six major marathons in China1. Our unrivaled dominance was further extended as Saucony demonstrated impressive wear rates and ranked third in prominent marathons1. Leveraging our esteemed reputation in running and the synergies between the core Xtep brand, Saucony and Merrell, coupled with the long-term government measures aimed at boosting consumer confidence and stimulating economic growth, we are well-prepared to harness this potential to drive our future success.”

Business Review

Core Xtep brand

“Professional-to-mass influence” strategy proves effective

Reaffirming its position as the No.1 running brand in China

Reaffirming its position as the No.1 running brand in China

Having previously secured the Group’s dominance in running with the highest wear rates among sub-three-hour marathon runners, Xtep now consistently holds the top position in wear rates among all runners in major marathons, demonstrating the effectiveness of its “professional-to-mass influence” strategy. In the six major marathons of 2024 and 2025 – Shanghai, Beijing, Xiamen, Guangzhou, Wuxi, and Chengdu – Xtep achieved a remarkable clean sweep, recording the highest wear rates among all participants and sub-three-hour runners1.

At the 2024 Shanghai Marathon, one of only two Platinum Label Road Races in China recognized by World Athletics, Xtep running shoes boasted an overall wear rate of 22.4%1. This marked the first time the brand surpassed international brands to secure the top position among all runners. Xtep’s unrivaled dominance was further reinforced by Saucony’s impressive wear rates in prominent marathons. The combined wear rate of the core Xtep brand and Saucony among all runners in the Guangzhou and Chengdu marathons reached 40.3% and 47.6%, respectively1, solidifying its position as the number one running brand in China.

Best-in-class flagship products engineered to break new marathon records

In the 2024 Xiamen Marathon, Dong Guojian wore the “160X 5.0 PRO” to secure the domestic championship, breaking the Chinese men's record that had stood for sixteen years. In March 2024, He Jie broke the national marathon record once again, ushering China into the “2:06” era. Xtep’s “160X” series also helped Yang Jiayu win gold in the women’s 20 km race walking event in Paris, marking China’s first gold in track and field at the 2024 Paris sports event. As of 31 December 2024, Xtep has helped 95 athletes claim 451 championships.

Xtep also introduced several flagship championship running shoes, including “160X 6.0 PRO”, “160X 6.0”, “360X” and “260X 2.0”, designed to satisfy the needs of runners of all ability levels, from mass market runners to professional and elite athletes. The “160X 6.0 PRO” offers improved resistance to degradation and increase in rebound strength, with enhanced running economy and lighter weight. In March 2025, the Group further upgraded the model and launched the “160X 6.5 PRO”, featuring improved midsole bonding, superior cushioning support and reinforced insoles to help athletes maintain peak speeds.

Since 2007, the Group has established the largest running ecosystem in Mainland China by nurturing a vibrant running community. In 2024, the Group sponsored renowned marathons and running events throughout China, endorsing a total of 44 events. These included the illustrious Xiamen Marathon, a prestigious World Athletics Platinum Label event and several esteemed Gold Label marathons. Meanwhile, the Group offers seamless professional services to Xtep Runners Club Members through 72 Xtep Running Clubs (XRCs), which are strategically located in popular running venues across China. By organizing running events through the XRCs and their affiliated groups, it has further deepened community engagement.

Retail Management and DTC Strategy

Effective retail management has significantly enhanced the Group’s brand image. Its ninth-generation stores feature spacious, aesthetically captivating designs that integrate advanced technologies. These enhancements not only increase average transaction values, but also improve overall store productivity. As at 31 December 2024, there were 6,382 Xtep Adult branded stores, mainly operated by authorized distributors in Mainland China and overseas (31 December 2023: 6,571).

In today's rapidly evolving retail landscape, the Group is convinced that increased investment in a DTC strategy for the core Xtep brand will be instrumental in its future growth. By enhancing its direct sales initiatives inspired by Saucony’s remarkable success in retail network management, Xtep can cultivate deeper, more personalized customer engagement, foster brand loyalty and boost retention rates. The brand will be well-positioned to swiftly adapt its product offerings, marketing strategies, and customer experiences, improving operational efficiency and facilitating brand upgrade. Looking ahead, the core Xtep brand also intends to gradually streamline its retail channel structure from distribution model to ensure timely and precise market insights, ultimately driving meaningful sales growth.

E-commerce

The e-commerce business continued to be a powerful driver of the Group’s development, demonstrating robust growth of approximately 20% in 2024. This segment accounted for over 30% of the core Xtep brand’s total revenue, underscoring its critical role in the overall business strategy of the Group. Emerging platforms, including Douyin, WeChat Channels and Rednote, appeared as standout retail channels, achieving an over 80% growth and capturing the attention of consumers seeking interactive shopping experiences.

Xtep Kids

Xtep Kids offers a holistic health development solution for Chinese children through a combination of products, data insights, training courses, and expert guidance. Together with the launch of the “A+ Healthy Growth Sneaker”, these initiatives have yielded remarkable results, as evidenced by the rapid growth of its business and profitability. As at 31 December 2024, there were 1,584 Xtep Kids stores in Mainland China (31 December 2023: 1,703), predominantly operated by the Group’s authorized distributors.

Saucony and Merrell

As the first new brand to achieve profitability in 2023, Saucony has maintained an impressive growth trajectory again this year, surpassing RMB1 billion in revenue. In 2024, revenue from the professional sports segment realized a year-on-year growth of 57.2% to RMB1,250.3 million, accounting for 9.2% of the Group’s total revenue. The segment also recorded an operating profit of RMB78.2 million (2023: RMB8.4 million), a substantial increase compared to 2023.

Saucony has significantly increased its brand recognition among elite runners, with wear rate ranking top three among international brands in prominent domestic and international marathons2. To capitalize on this momentum, Saucony has embarked on an exciting rebranding journey that encompasses retail channels, product offerings, and marketing. This initiative includes the launch of new flagship and concept stores in premium shopping malls, as well as an expanded range of apparel and lifestyle products designed to appeal to a broader customer base and enhance their experience. The first-ever concept store and urban store of Saucony were unveiled at The Mixc Shenzhen and Hopson One Mall in Beijing, respectively. As at 31 December 2024, there were 145 Saucony stores in Mainland China.

By prioritizing the expansion of its e-commerce business, Merrell has provided outdoor enthusiasts with high-performance apparel and footwear that seamlessly blend comfort and functionality. In 2024, the brand organized a series of outdoor events to allow athletes to experience its products firsthand. Through these activities, Merrell not only celebrates the passion for outdoor sports, but also strengthens its commitment to inspiring people to seize every opportunity to explore and connect with the natural world.

Sustainability

In July 2024, Xtep distinguished itself as the first company in the Chinese sporting goods sector to attain an “A” rating in MSCI ESG Rating. To further emphasize the Group’s commitment to integrating environmental protection and social responsibility into its business development, Xtep officially unveiled its 2030 ESG strategic framework. This framework centers on three core pillars: “protect the planet”, “create a sustainable value chain” and “put people first”, supported by eight specific objectives, showcasing the strategic enhancement to its “10-Year Sustainability Plan”.

Prospects

The Group’s well-defined strategy of concentrating on running has created a clear roadmap for achieving long-term growth. As one of the earliest movers in the running segment, Xtep’s dedicated efforts to enhance research and development and to build the largest running ecosystem have culminated in its emergence as the number one running brand in China. The Group will continue to leverage synergies among the core Xtep brand, Saucony, and Merrell, ensuring that their combined strengths amplify market share.

Xtep’s “160X” running shoe series has witnessed the birth of numerous championships, enabling the brand to achieve the highest wear rate in prominent marathons and solidifying its dominant leadership in the running segment3. As a domestic brand dedicated to delivering value-for-money products to the mass market, Xtep will persist in enhancing product performance and crafting running shoes tailored specifically for Chinese runners, empowering them to achieve their personal milestones. In addition, the commitment to enhancing investment in the DTC strategy will enable Xtep to gain direct access to data and customer interactions, allowing the company to strengthen its retail management, accelerate its growth trajectory, and achieve sustainable profitability.

Saucony has rapidly become the new favourite among runners, serving as the second growth driver for the group. Ranked among the top three brands in wear rates in Chinese marathons3, its legacy as a century-old icon in the running world has been further solidified. Since 2020, Saucony has primarily relied on the DTC model to expand its retail network in China. This DTC strategy has fueled the rapid growth of the professional sports segment over the past five years. The segment’s revenue achieved a compound annual growth rate of over 100% from 2020 to 2024, reaching breakeven in 2023 and continued to demonstrate resilience in 2024. As Saucony scales up its business operations in China, it will further enhance its branding initiatives and will continue its efforts to launch new flagship and concept stores with elevated aesthetics, paving the way for the expansion of its apparel and lifestyle offerings.

The Group anticipates a stable growth in demand for sportswear products and is poised to seize market opportunities through a flexible supply chain that enables it to respond swiftly to changing consumer preferences and trends. The increasing popularity of running, along with government initiatives to boost consumption, has fostered a promising environment for the sportswear sector, serving as a catalyst for long-term growth.

Appendix

2024 Annual Results Financial Highlights

|

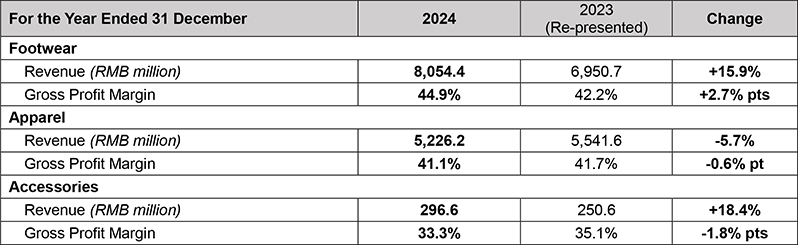

Group Revenue from Continuing Operations & Gross Profit Margin Breakdown

By product

|

By brand nature

|

About Xtep

Business Model

Our Brands

Investor Relations

Sustainability