Media

Corporate News

Back

| Highlights |

|

18 August 2025, Hong Kong – Leading PRC-based professional sportswear enterprise Xtep International Holdings Limited (the “Company”, together with its subsidiaries, the “Group”) (Stock code: 1368. HK) today announced its unaudited interim results for the six months ended 30 June 2025 (“1H2025”, “Period”).

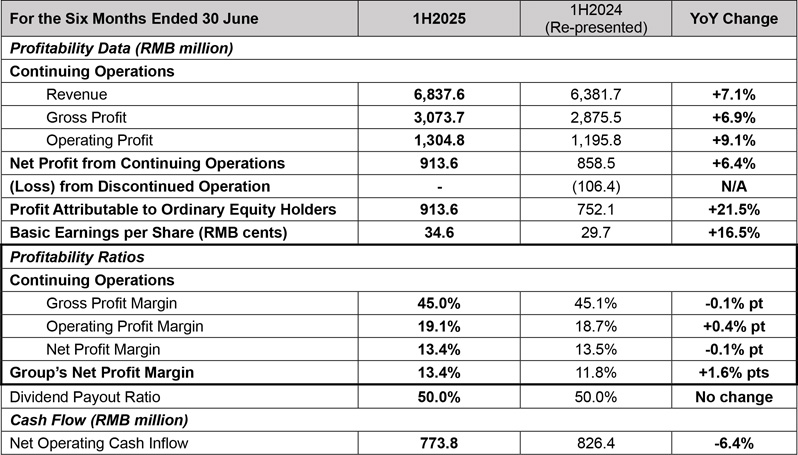

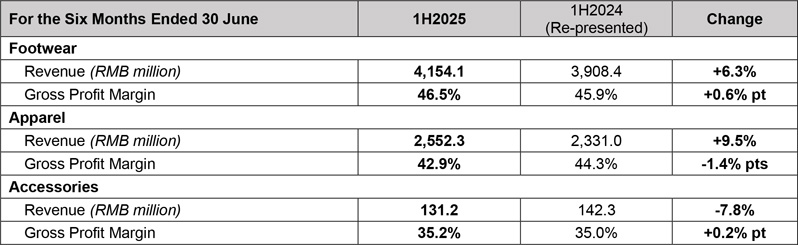

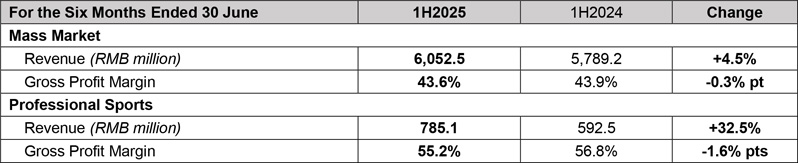

Against the sustained macroeconomic recovery supported by the government policies aimed at stimulating the economy, the Group delivered resilient results in the first half of 2025. Revenue of the Group’s continuing operations increased by 7.1% to RMB6,837.6 million (1H2024: RMB6,381.7 million). Revenue of the core Xtep brand increased by 4.5% to RMB6,052.5 million (1H2024: RMB5,789.2 million). Revenue of the professional sports segment climbed by 32.5% to RMB785.1 million (1H2024: RMB592.5 million). Gross profit margin of the Group’s continuing operations reached 45.0% (1H2024: 45.1%). Operating profit of the Group’s continuing operations grew by 9.1% to RMB1,304.8 million (1H2024: RMB1,195.8 million). Including a loss of RMB106.4 million from the discontinued operation (K·SWISS and Palladium) in 1H2024, profit attributable to ordinary equity holders of the Company for 1H2025 amounted to RMB913.6 million (1H2024: RMB752.1 million), up 21.5%. Basic earnings per Share were RMB34.6 cents (1H2024: RMB29.7 cents). The Group’s annualized return on total equity holders’ equity was 19.7% (1H2024: 16.4%), increased by 3.3 percentage points year on year.

Given the Group’s healthy cash flow, the Board has declared an interim dividend of HK18.0 cents per Share (1H2024: HK15.6 cents), up 15.4% year on year, with an option to receive scrip shares in lieu of cash, representing a dividend payout ratio of 50.0% (1H2024: 50.0%). The Group has maintained a payout ratio of no less than 50% for 17 consecutive years since its listing, underscoring its long-standing commitment to shareholder returns.

Mr. Ding Shui Po, Chairman and Chief Executive Officer of Xtep International Holdings Limited, said, “Our strategic focus on running has solidified our unparalleled position as China’s leading running brand. The outstanding achievements in wear rate of China’s major marathons perfectly demonstrate Xtep’s unrivaled dominance and the effectiveness of our ‘professional-to-mass influence’ strategy, illustrating the core Xtep brand’s success in resonating deeply with a broader mass market audience, while simultaneously celebrating Saucony’s remarkable ascent. With the ongoing support of government policies promoting the sports industry and a sustained rise in sports participation, we are well-positioned to maintain our leadership in the running sector. We will strive to maximize synergies between the core Xtep brand, Saucony and Merrell to enhance the Group's market share.”

Business Review

Core Xtep brand

Strengthening its lead as China’s top running brand

Xtep has redefined excellence in China's running revolution, achieving an unprecedented feat in Chinese marathon history. In the first half of 2025, we not only maintained our reign as the preferred choice of elite athletes, achieving the highest wear rate among sub-three-hour finishers, but also secured the top overall wear rates at three flagship events – the Xiamen, Wuxi, and Lanzhou marathons. This dual victory with simultaneous leadership among professionals and mass participants stands as powerful validation of our “professional-to-mass influence” strategy.

Meanwhile, Saucony surpassed expectations, emerging as the top-performing international brand in overall wear rate across the three major marathons. Notably, it secured second place at the 2025 Wuxi Marathon, setting a new brand record and outperforming all other international brands.

Victory-engineered “160X” series

Xtep’s “160X” championship running shoes have continued to empowered athletes to redefine the limits of speed on both national and global stages. At the 2025 Tokyo Marathon, He Jie achieved his personal best overseas performance, while Yang Shaohui, wearing the “160X” running shoe, made Chinese history by breaking the elusive sub-2:10 barrier. Yang Shaohui’s record-breaking momentum continued at the illustrious Xiamen Marathon, a World Athletics Platinum Label race, where he broke the Chinese men’s marathon record. Our “160X” series also helped Yang Shaohui and Xu Bingjie win domestic championships in the Wuxi Marathon. As of 31 July 2025, Xtep has empowered 107 elite athletes to win 507 championship titles.

Xtep unveiled several flagship running shoes, including the “160X 7.0 PRO”, “160X 7.0”, “360X 2.0” and “Qingyun”, designed to empower runners at every level, from everyday enthusiasts to elite competitors. The newly launched “160X 7.0 PRO”, introduced in August, features “XTEP ACE+” midsole technology and “XTEP DURA,” offering runners enhanced rebound, propulsion, and slip resistance. To further diversify our product offerings and deliver value-for-money sportswear to the mass market, we unveiled the brand-new “Qingyun” flagship cushioning running shoe series. This series is designed to provide a “peace of mind in every step” running experience, ensuring a comfortable and ergonomic fit for all runners.

Cultivating a thriving running community

In the first half of 2025, we partnered with 27 marathons and running events across China, including the Xiamen Marathon, a World Athletics Platinum Label race and several Gold Label marathons. In addition, we provide comprehensive professional services to Xtep Runners Club Members through 70 Xtep Running Clubs, which are in premier urban parks and high-traffic running destinations in China. By hosting carefully curated events at club venues and in collaboration with affiliated running groups, Xtep has actively cultivated community participation while strengthening the growth and connectivity of its running ecosystem.

Retail management and DTC strategy

By seamlessly integrating cutting-edge technology with premium in-store service, Xtep has fostered deeper engagement with tech-savvy consumers, resulting in measurable gains in brand preference and repeat purchases among its core audience. Around 70% of our retail outlets are new image stores to provide immersive customer experience. As China’s retail market continues to evolve, Xtep expects to achieve further success in retail network management through investment in a direct-to-consumer (DTC) strategy which will commence in the second half of 2025. This approach will enable Xtep to respond swiftly to shifting consumer preferences and enhance customer engagement, paving the way for sustained growth in this dynamic market.

As at 30 June 2025, there were 6,360 Xtep Adult branded stores, mainly operated by authorized distributors in Mainland China and overseas (31 December 2024: 6,382).

E-commerce

The e-commerce business remained a powerhouse of growth in the first half of 2025, accounting for over 30% of the core Xtep brand’s total revenue. By leveraging data-driven insights, Xtep developed customized strategies for each digital channel to achieve precise audience targeting, maximize conversion efficiency, and enhance engagement. These platform-specific initiatives have cemented online sales as a critical revenue stream, recording double-digit year-on-year growth.

X Young

Xtep has consistently prioritized child development and empowered young athletes through proven technology and holistic health development solutions. In August, we launched the "Xtep Growth Shoes" series, which features three innovative technologies to offer exceptional support and stability. We also partnered with eight authoritative institutions, including the Department of Maternal and Child Health of the National Health Commission, the Institute of Sports Medicine at Peking University Third Hospital, and the Tsinghua University Sports and Health Science Research Center, to publish the Blue Book on China Youth Sports and Growth, offering evidence-based guidance for enhancing youth height growth through sports. As at 30 June 2025, there were 1,564 X Young stores in Mainland China (31 December 2024: 1,584), predominantly operated by the Group’s authorized distributors.

Saucony and Merrell

Saucony achieved a major milestone in 2024 by surpassing RMB1 billion in revenue, and it continued its strong performance into 2025. In the first half of 2025, the professional sports segment recorded robust year-on-year growth of 32.5%, generating RMB785.1 million in revenue and contributing 11.5% of the Group’s total revenue. The segment also saw a significant rise in profitability, with operating profit reaching RMB78.6 million (1H2024: RMB23.3 million), marking a substantial increase of 236.8% year on year.

Saucony consistently ranks among the most-worn international labels at major marathons in China, highlighting its prestigious reputation. To further elevate its high-end sports image, Saucony has undergone a bold transformation, refining everything from its brand positioning to its store designs and product lines. Premium flagship stores are now debuting in upscale malls, while an innovative lineup of running apparel and lifestyle gear is expanding its appeal beyond professional athletes. Through this strategic evolution, Saucony has masterfully balanced its performance heritage with contemporary retail innovation, attracting new consumers while deepening brand loyalty. As at 30 June 2025, there were 155 Saucony stores in Mainland China.

Merrell continues to push boundaries in outdoor performance gear, empowering adventurers to conquer new terrain with confidence. Through focusing on e-commerce and the three core product lines, including trail running, hiking and water hiking, Merrell leverages innovative technologies to enhance performance, comfort, and durability.

ESG

Xtep has strengthened its dedication to sustainable growth by embedding environmental protection, social responsibility, and corporate governance across all aspects of its business operations. In 2025, we received an MSCI ESG Rating of "AA" and an Wind ESG Rating of "AA". To demonstrate our commitment to sustainable manufacturing, Xtep has taken proactive steps to eliminate hazardous chemicals from its supply chain, by becoming a signatory to the "Zero Discharge of Hazardous Chemicals" initiative and organizing a supplier training conference centered on chemical management best practices. The Group also successfully launched a clothing recycling initiative on Earth Day, attracting over 3,400 participants and collecting over 2,900kg of used clothing. Through repurposing discarded textiles, we reinforced our commitment to circular fashion and encouraging sustainable consumer behavior.

Prospects

The Group’s strategic focus on the running sector has established a robust framework for long-term success. Through continuous innovation and significant investment in research and development of this field, we have created an industry-leading running ecosystem and consolidated our position as China’s top running brand. We will continue to leverage the synergistic strengths of our core portfolio – Xtep, Saucony, and Merrell – to create a stronger collective impact and further expand our market presence.

As a homegrown leader committed to delivering premium yet value-for-money gear, Xtep continues to push technological boundaries, designing shoes that cater to the distinct running styles of Chinese athletes, enabling them to surpass their personal bests. Building on this momentum, we will elevate our retail strategy by adopting a direct-to-consumer model in the second half of 2025. By accelerating our responsiveness to shifting consumer demands and delivering superior shopping experiences, we can enhance product innovation, optimize marketing strategies, and boost operational efficiency, thereby laying the foundation for sustainable long-term growth.

With a clear brand positioning as a running heritage leader boasting a century-old history, Saucony has solidified its role as the Group’s second growth engine. Its dominance in China’s major marathons — where it now ranks as the top-worn international brand — further reinforces its legacy in professional running. Beyond advancing the R&D of high-performance running products, Saucony is intensifying its brand-building efforts to deepen engagement with professional runners and social elites in China. In the second half of 2025, Saucony will launch innovative flagship and concept stores in prime locations, alongside an expanded apparel and lifestyle collection. To complement this brand elevation, we are overhauling the e-commerce platform to ensure seamless integration of its online and offline offerings, paving the way for the next chapter of Saucony’s growth in China’s premium sportswear market.

The sportswear sector continues to demonstrate resilient demand, supporting stable growth expectations. We remain optimistic about the industry outlook for the second half of 2025, driven primarily by structural tailwinds such as rising health awareness, continued growth in running participation, and government-led incentives to boost consumption. Our competitive position is further strengthened by an optimized supply chain infrastructure, enabling us to respond swiftly to evolving consumer trends and emerging market opportunities. We are confident in our ability to further enhance value creation while effectively managing near-term volatility.

Appendix

2025 Interim Results Financial Highlights

|

Group Revenue from Continuing Operations & Gross Profit Margin Breakdown

By product

|

By brand nature

|

About Xtep

Business Model

Our Brands

Investor Relations

Sustainability