Media

Corporate News

Back

| Highlights |

|

18 March 2024, Hong Kong – Leading PRC-based professional sportswear enterprise Xtep International Holdings Limited (the “Company”, together with its subsidiaries, the “Group”) (Stock code: 1368. HK) today announced its annual results for the year ended 31 December 2023 (“2023” or “the year”).

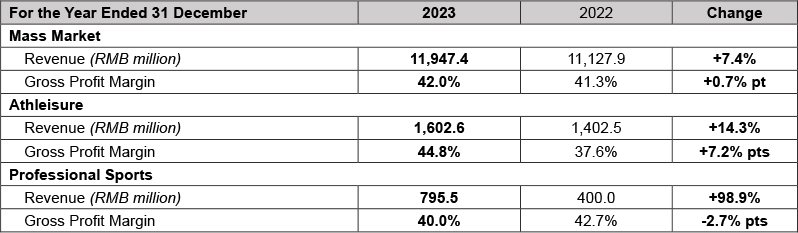

2023 was a landmark year for the Group as it celebrated its 15th anniversary of listing on the Hong Kong Stock Exchange. During the 15-year journey, the Group has weathered the ups and downs of various economic cycles, while expanded its business into a globally diversified portfolio. The Group’s revenue increased by 10.9% to an all-time high of RMB14,345.5 million (2022: RMB12,930.4 million). Mainland China business delivered strong resilience. Revenue of the core Xtep brand reached a record high of RMB11,947.4 million (2022: RMB11,127.9 million). Revenue of professional sports segment was almost doubled, with Saucony becoming the first new brand to turn a profit. Athleisure segment’s revenue in Mainland China also soared by 224.3%, driven by our relentless efforts in product development and rebranding.

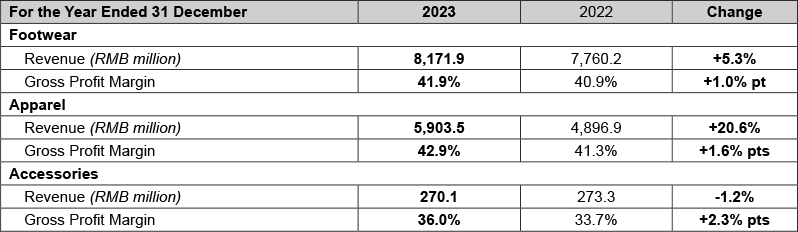

The Group’s gross profit margin lifted to 42.2% (2022: 40.9%), with the operating profit registering an increase of 7.9% to RMB1,579.9 million (2022: RMB1,464.3 million). Profit attributable to ordinary equity holders of the Company also hit an all-time high of RMB1,030.0 million (2022: RMB921.7 million), an increase of 11.8%. Basic earnings per Share was RMB40.8 cents (2022: RMB36.6 cents). The Group’s working capital demonstrated strong efficiency. Inventories of the Group remarkably declined by 21.6% to RMB1,793.8 million (2022: RMB2,287.2 million), with net operating cash inflow surged by 119.5% to RMB1,254.9 million (2022: RMB 571.8 million).

The Board has proposed a final dividend of HK8.0 cents per Share (2022: HK7.1 cents per Share), with an option to receive scrip shares in lieu of cash. Together with an interim dividend of HK13.7 cents per Share, the full-year dividend payout ratio was approximately 50.0% (2022: 50.0%).

Mr. Ding Shui Po, Chairman and Chief Executive Officer of Xtep International Holdings Limited, said, “Throughout the year, the Group made immense efforts to enhance operational efficiency and alleviate inventory pressure on the core Xtep brand, while unlocking the potential of our new brands in Mainland China to strengthen our brand positioning strategies within our multi-brand portfolio. Our industry-leading position in the running segment has continued to fuel the Group's business growth. We are proud to share that Xtep outperformed both international and domestic brands in Mainland China's most prestigious marathons, securing the leading position in terms of wear rates. Although challenges lie ahead, 2024 holds tremendous promise and untapped potential. With our established track record in the running segment, our strategic focus on mass market consumers, and government support for the sports industry, we remain confident in the continued recovery of the sportswear sector and our ability to drive future success.”

Business Review

Mass Market

Core Xtep brand

Leading position in running

With superior product quality and performance, Xtep running shoes have gained widespread recognition of a broad range of running enthusiasts, solidifying the brand’s unwavering dominance in China’s running market. In the major marathons held in Mainland China in 2023, Xtep achieved the highest wear rate among all runners and sub-three hour runners, ranking first among international and domestic brands. In 2023, Xtep emerged as the preferred brand among runners participating in the Xiamen, Beijing and Guangzhou Marathons and among sub-three hour runners in the Shanghai Marathon. Continuing its remarkable performance, Xtep maintained its dominant position in the recently concluded 2024 Xiamen Marathon, boasting a wear rate of 41.8% and 43.8% among all participants and sub-three hour marathoners respectively. Xtep also clinched the top position in wear rate among the top 100 Chinese male and female runners for two consecutive years, which clearly underscores its brand positioning as a professional running brand.

Product targeting strategies from professional runners to mass market

The “160X” carbon fiber plate running shoes continue to be competitive in helping Chinese athletes set personal records and create national history. As of 31 December 2023, this series has helped 83 Chinese athletes in achieving 370 championships. In 2023, Xtep’s running shoes were instrumental in numerous sports personalities breaking national records and making history. Notable examples include Yang Shaohui, the national marathon record holder; He Jie, China’s first men’s marathon gold at the Asian games; and Dong Guojian, an evergreen marathoner who achieved under 2:10:00 five times in his professional career. In addition, the “160X 5.0” running shoe made its debut at the Berlin Marathon, one of the Word Marathon Majors, where Josphat Kiptoo Boit set a new personal record in September 2023.

To meet the diverse needs of runners, Xtep unveiled the “260X” carbon fiber plate running shoe in December 2023. Designed for both elite and professional runners in competition and training scenarios, the new collection is armed with midsole technology made of materials with higher propulsion capabilities compared with “260 2.0”, offering a 14.5% increase in propulsion. The shoe also features a marathon-grade CPU outsole, which effectively reinforces runners’ durability and allows them to handle long-distance training.

In March 2024, Xtep further broadened its offerings with the launch of the “360X”, a carbon fiber plate running shoe suitable for mass market runners who have cultivated a regular running routine. With stability at its core, the “360X” employs advanced midsole technology made of materials that provide enhanced support. In addition, the carbon fiber plate of the “360X” is designed to effectively minimize runners’ risk of injury, allowing the shoe to demonstrate a 4.2% increase in stability compared with the “360” series. With a highly competitive pricing among all carbon fiber plate running shoes in the market, “360X” is expected to attract considerable attention from the mass market runners.

Fostering our leadership in running

As the public’s passion for running continues to surge, Xtep has continued to strengthen its running ecosystem and sponsor prominent marathons in Mainland China, including the Xiamen Marathon, a highly prestigious World Athletics Platinum Label sponsored by Xtep for 16 consecutive years. Additionally, Xtep supported other Gold Label marathons such as the Chongqing Marathon, the Yangzhou Jianzhen Half Marathon, the Taiyuan Marathon and the Changsha Marathon.

Xtep has remained committed to spreading the unifying power of running and providing one-stop professional running services to runners through Xtep Running Clubs. Capitalizing on the rising popularity of running, it launched a new Xtep Running Club in Xi’an Daming Palace, making it the world’s first running club situated within a UNESCO World Heritage Site. As at 31 December 2023, there were 65 Xtep Running Clubs across Mainland China and over two million Xtep Runners Club members.

Retail management and branding

Our ninth-generation stores have significantly enhanced our brand image with larger store size and vibrant visual merchandising, such as lighting control, AI robots, digital signage and rising stages, leading to an increase in foot traffic and cross-selling ratio. Prioritizing digital-first engagement with consumers, the new format stores have also achieved remarkable results in attracting and connecting with younger consumers. As at 31 December 2023, there were 6,571 Xtep Adult branded stores mainly operated by authorized distributors of the Group in Mainland China and overseas (31 December 2022: 6,313).

Xtep Kids

Xtep Kids’ business continued to be the growth driver of the core Xtep brand during the year, achieving sustainable development with a focus on professional sports. In 2023, Xtep Kids collaborated with Shanghai University of Sport and Tsinghua University to launch an upgraded version of "Xtep 100 2.0 PRO" physical education examination shoe to improve the sports performance in school-age children, and actively sponsored various sports competitions and activities to enhance children's physical fitness. As of 31 December 2023, there were 1,703 Xtep Kids stores in Mainland China (31 December 2022: 1,520), predominantly operated by the Group’s authorized distributors.

Professional Sports

Saucony and Merrell

Thanks to its exceptional design and superior product performance, Saucony has attracted considerable attention from an expanding customer base, thus sustaining a strong growth trajectory. In 2023, the revenue generated from the professional sports segment exhibited robust performance and soared by 98.9% to reach RMB795.5 million, accounting for 5.5% of the Group’s total revenue. Of note, Saucony became the first new brand to turn a profit.

Leveraging its outstanding design and quality, Saucony has experienced remarkable growth in brand awareness among Chinese consumers, accompanied by a rapid increase in store productivity and an encouraging expansion throughout Mainland China. To further enhance control and synergies with Xtep in product innovation, marketing, and distribution channels, the Group announced the acquisition of Wolverine Group’s interests in the 2019 Joint Venture to carry out sale and distribution of products under Saucony and Merrell brands, as well as 40% of Saucony’s intellectual property rights in China in December 2023. These transactions demonstrated Xtep’s confidence and commitment to the business development of both brands and their growth potential in China.

Xtep remains committed to the expansion and enhancement of Saucony’s retail network in Mainland China. Following the successful launch of its first third-generation image store at the Shanghai Super Brand Mall in June 2023, Saucony continued to expand its retail presence in Tier 1 cities while establishing its retail footprint in premium shopping malls in Tier 2 cities. As of 31 December 2023, there were 110 Saucony stores and four Merrell stores in Mainland China.

Athleisure

K‧SWISS and Palladium

While the overseas market for K‧SWISS and Palladium has experienced stagnation, both brands have made remarkable progress in rebranding efforts within Mainland China, as evidenced by the rapid increase in brand recognition and store productivity. In 2023, revenue from the athleisure segment increased by 14.3% to RMB1,602.6 million, accounting for 11.2% of the Group’s revenue. Revenue from Mainland China grew rapidly by 224.3%, its revenue contribution also significantly increased from 10.2% in 2022 to 29.0% in 2023. As K‧SWISS and Palladium continue to enhance their product portfolios and retail network, they are beginning to reap the rewards of their successful rebranding initiatives in Mainland China. In particular, one of K‧SWISS’ pilot stores in Changchun achieved an annual store productivity of over RMB10 million, serving as a strong testament to the brand’s exceptional product design and quality. Throughout the year, K‧SWISS accelerated the opening of stores in premium shopping malls in higher-tier cities in Mainland China, including the first store in Shenzhen at the Coastal City Shopping Center. As of 31 December 2023, there were 101 K‧SWISS stores in Asia Pacific, including Mainland China.

To cater to the high-end consumer segment, Palladium also expanded its presence by opening new stores in various higher-tier cities in Mainland China. Following the launch of a new store in Beijing in September 2023, Palladium further expanded its footprint in Southern China with the opening of its first store in Shenzhen at The Mixc World in November 2023. As of 31 December 2023, there were 94 Palladium stores in Asia Pacific, including Mainland China.

Prospects

The core Xtep brand has strategically positioned itself in the running field, actively building the largest running ecosystem in Mainland China, and taking a leading position in the market. As a domestic brand that offers value-for-money products to the mass market, the core Xtep brand will continue to enhance its research and development capabilities, refine the performance of its products, and create running shoes that are tailored for Chinese runners, helping them to achieve personal breakthroughs.

Possessing the capabilities to compete with rival international brands on the world stage, the Group is committed to maximizing the synergies for success. The strategic move to consolidate ownership of the joint venture entities of the Saucony and Merrell brands will not only maximize synergies in product innovation, marketing and distribution channels with the core Xtep brand, but also enhance operational efficiency to unleash the full growth potential of these brands. Looking ahead, the Group will expand the business scale for the Saucony and Merrell brands through customized collections that are catered for Chinese consumers, while exploring business opportunities in the global market. Meanwhile, Saucony will further develop its “Originals” and “Commuter” series to broaden its range of fashion and lifestyle offerings, in addition to its existing “Performance” series, to address the increasing demand for personalized and versatile products across various scenarios throughout China.

As consumers in the U.S. and Europe have continued to be cautious about discretionary spending due to high inflation, the overseas athleisure business saw sluggish growth in 2023. In contrast, the strong growth momentum of K‧SWISS and Palladium in Mainland China – driven by a successful rebranding campaign, has raised our confidence in the sustainable development of the athleisure segment. To capitalize on an uptick in demand for athleisurewear, the two brands will continue to accelerate growth through new store openings in high-tier cities and product mix optimization. While K‧SWISS will launch tennis-inspired sportswear to accentuate its professionalism in tennis, Palladium will roll out stylish collections that capture the hearts of younger consumers.

Driven by the growing emphasis on a healthy lifestyle and supportive national policies to promote sports development, Mainland China's sports consumption has demonstrated tremendous resilience and a notable recovery in 2023. These favorable factors, coupled with the Chinese government’s pledge to implement proactive fiscal policies in 2024, such as expanding domestic demand to revive the economy, has boosted market confidence. The sportswear sector in Mainland China is poised for a continuous upswing in 2024 and beyond, presenting encouraging long-term prospects.

Appendix

2023 Annual Results Financial Highlights

|

Group Revenue & Gross Profit Margin Breakdown

By product

|

By brand nature

|

About Xtep

Business Model

Our Brands

Investor Relations

Sustainability